Explore opportunities for buying a home with great features and benefits still to be widely recognized.

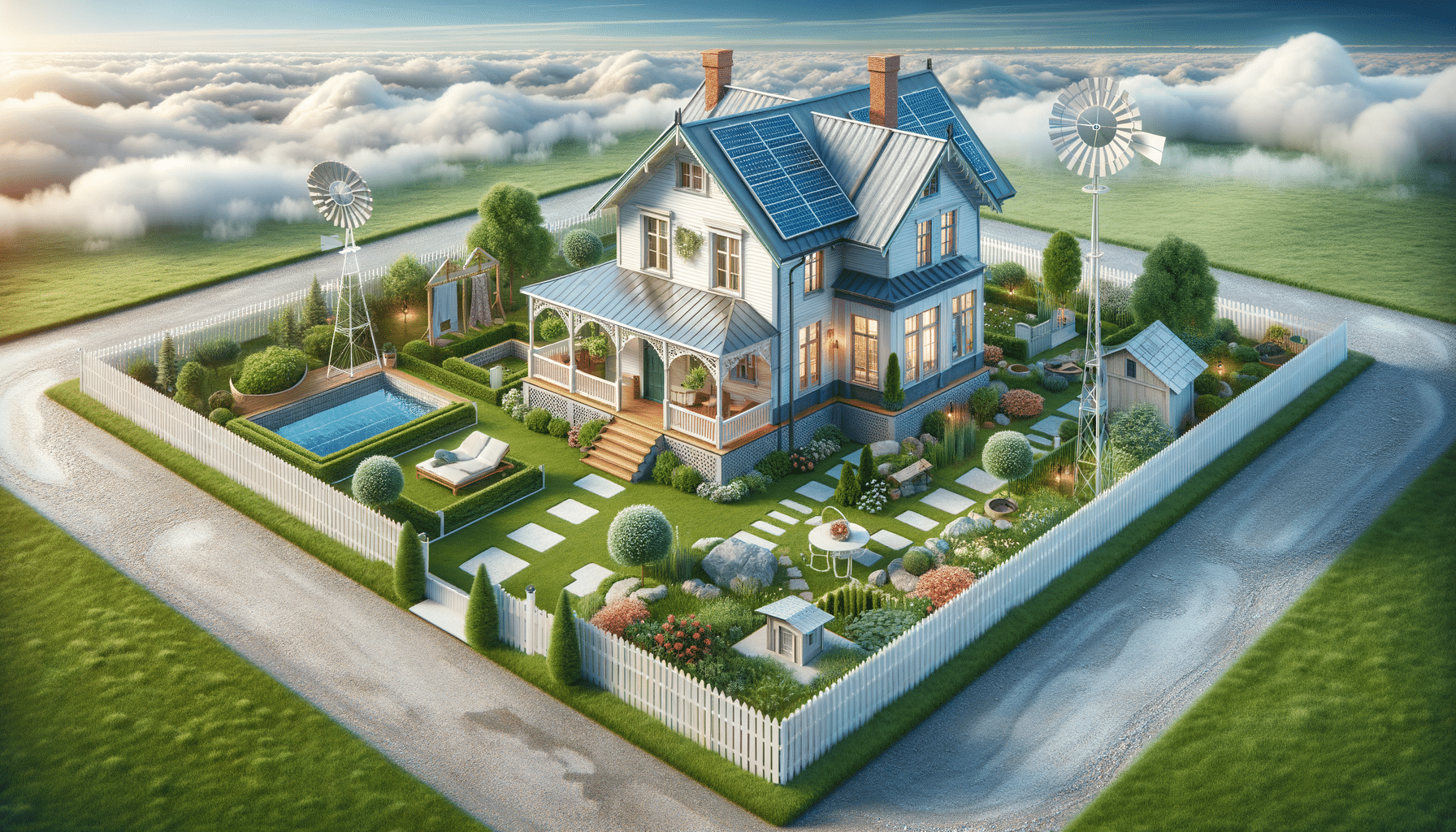

Imagine buying a house with all utilities pre-installed in a well-located area—an exceptional opportunity to find your dream home with fewer challenges.

Understanding the Real Estate Market

Before embarking on the journey of buying a house, it’s crucial to understand the dynamics of the real estate market. This market is influenced by various factors including economic conditions, interest rates, and government policies. For instance, a booming economy often leads to an increase in housing demand, pushing prices up. Conversely, during economic downturns, housing prices may stabilize or even decrease.

Interest rates also play a significant role. Lower interest rates generally make borrowing cheaper, encouraging more people to buy homes, which can drive up prices. On the other hand, higher interest rates can dampen demand. It’s important to keep an eye on these trends and consult with real estate professionals to gauge the right time to buy.

Government policies, such as tax incentives for first-time buyers or changes in property taxes, can also impact the market. Staying informed about these factors will help you make a more informed decision when purchasing a home.

Choosing the Right Location

Location is often cited as the most critical factor in real estate. A well-located house not only provides convenience but also tends to appreciate in value over time. When selecting a location, consider proximity to essential amenities such as schools, hospitals, and shopping centers. Easy access to public transportation and major highways can also enhance the value of your property.

Moreover, research the neighborhood’s safety, community vibe, and future development plans. A safe, vibrant community with upcoming infrastructure projects may offer a promising return on investment. Additionally, think about the type of neighborhood that suits your lifestyle. Urban areas may offer more excitement and convenience, while suburban or rural areas might provide peace and space.

Ultimately, the right location aligns with your personal and financial goals, offering a balance between cost and convenience.

Financing Your Home Purchase

Securing the right financing is a pivotal step in buying a house. Most buyers rely on mortgages, and understanding the different types available is essential. Fixed-rate mortgages offer stability with a consistent interest rate and monthly payment, making them a popular choice for many.

Alternatively, adjustable-rate mortgages (ARMs) may start with lower rates, which can rise or fall based on market conditions. While they can offer initial savings, they carry the risk of higher payments in the future. It’s crucial to evaluate your financial situation and risk tolerance when choosing a mortgage.

Additionally, consider the down payment amount. A larger down payment can reduce your mortgage amount and potentially lower your interest rate. There are also various programs available for first-time buyers that can assist with down payments and closing costs. Consulting with a financial advisor or mortgage broker can provide clarity and help you navigate the complexities of home financing.

The Home Buying Process

The process of buying a home involves several steps, each requiring careful consideration. Start by determining your budget and getting pre-approved for a mortgage, which will give you a clear idea of what you can afford and make you a more attractive buyer to sellers.

Next, work with a real estate agent who understands your needs and the local market. They can guide you through property viewings, negotiations, and paperwork. Once you find a home you like, make an offer. This may involve some negotiation to reach a mutually agreeable price.

After your offer is accepted, conduct a home inspection to identify any potential issues. This step is crucial as it can save you from costly repairs in the future. Finally, proceed to closing, where you’ll finalize the purchase, sign documents, and receive the keys to your new home.

Conclusion: Making Your Dream Home a Reality

Buying a house is a significant milestone that requires careful planning and consideration. By understanding the real estate market, choosing the right location, securing suitable financing, and navigating the buying process, you can make informed decisions that lead to a successful purchase.

Remember that this journey is not just about finding a house, but creating a home that fits your lifestyle and future aspirations. With patience and due diligence, you can turn the dream of homeownership into a rewarding reality.